These 2 Stocks’ Unusual Options Activity Flashes Strangle Plays

The big news on Wednesday was the quarter-point interest cut by the Federal Reserve.

While the White House was looking for a half-point cut, the markets don’t seem fazed by the move, primarily because the Fed is likely to cut rates in the final two Fed meetings of 2025. As a result, premarket trading on Thursday showed the S&P 500 futures hitting a record high.

There were 862 calls and 433 puts in yesterday's unusual options activity. The put/call volume ratio of 0.50 is extremely bullish.

Scrolling through the 1,295 unusually active options from yesterday’s action, the stocks with 30-day DTEs (days to expiration) jumped out at me. According to Barchart data, there were 11 stocks with an Oct. 17 expiration that had both calls and puts, the building blocks for long and short strangles.

Here are two worth considering, one long and one short.

Lyft (LYFT)

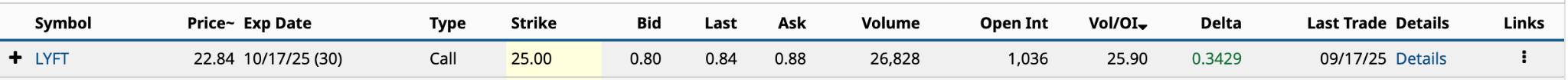

Lyft (LYFT) had six unusually active options yesterday, with four calls and two puts. The $25 call strike expiring on Oct. 17 had the highest Vol/OI (volume-to-open-interest) ratio at 25.90, the fifth-highest of options expiring in 30 days.

The long strangle involves buying a call option and buying a put option at a lower strike price. The strategy is used when you expect increased volatility resulting in a big move in either direction between now and expiration, in this case, 30 days.

The short strangle involves selling a call option and selling a put option at a lower strike price. The strategy is used when you expect decreased volatility, resulting in the share price remaining within a specific range between now and expiration.

I’ll use the $25 call because of its Vol/OI ratio. Now I need to pair it with a put from the two yesterday.

Lyft’s stock is up 21% in the past five days and 73% year-to-date. It is trading at its highest level since April 2022. The question is whether the latest move, which resulted from yesterday’s big announcement that it would launch autonomous ride-hailing services with Waymo in Nashville by 2026, will increase or decrease the stock’s volatility over the next 30 days.

Lyft’s stock is up 21% in the past five days and 73% year-to-date. It is trading at its highest level since April 2022. The question is whether the latest move, which resulted from yesterday’s big announcement that it would launch autonomous ride-hailing services with Waymo in Nashville by 2026, will increase or decrease the stock’s volatility over the next 30 days.

As Barchart contributor Elizabeth Volk wrote yesterday, Lyft has already met and exceeded Wall Street’s 12-month price target of $16.88; investors should proceed with caution at these prices.

My thought is that LYFT stock has come a long way in the past 30 days, up 40%, so it’s likely to take a bit of a breather. For this reason, I’d go with a short strangle rather than long.

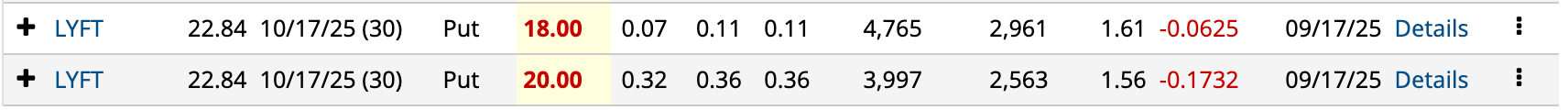

Using the put figures from yesterday’s close, the net credit for selling the $18 put and $25 call was $0.87, while the $20 put and $25 call combination was $1.12.

In the former, Lyft’s share price would need to stay between an upside breakeven of $25.87 (13.3%) and a downside breakeven of $17.13 (25.0%). In the latter, the upside and downside breakevens would be $26.12 (14.4%) and $18.88 (17.33%), respectively.

The percentages in the above paragraph are based on yesterday’s $22.84 closing price.

With an expected move of 10.32% over the next month in either direction, I would opt for the $20 put due to its higher net credit of $1.12 ($112).

Caterpillar (CAT)

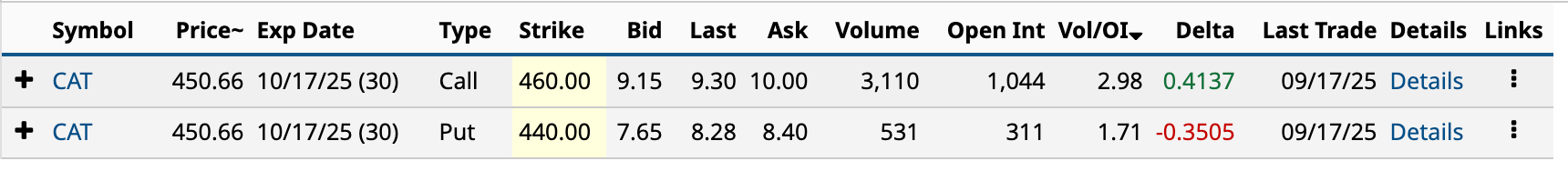

Caterpillar (CAT) had one put and call that was unusually active in Wednesday's trading. Neither option had massive volume on the day, but by my definition, they were unusually active--expiring in seven days or longer with Vol/OI ratios of 1.24 or higher.

Caterpillar’s stock has been reinvigorated in the past 24 months. The heavy equipment manufacturer’s shares are up 180% since Sept. 30, 2022.

I don’t think it’s any coincidence that the price of gold has doubled over this stretch. Caterpillar gets a decent amount of revenue from the mining industry. In Q2 2025, it generated a little over $3 billion in revenue from the resource sector.

Source: Goldprice.org

Interestingly, in Q2 2025, its revenue and operating income were $16.57 billion and $2.94 billion, respectively, both lower than the second quarter figures in both 2024 and 2023.

Yet its shares are up 77% since July 28, 2023, the last trading day before it reported its Q2 2023 results. The gains have all been from an expansion in the stock’s valuation multiples.

In Q1 2023, its enterprise value, according to S&P Global Market Intelligence, was 2.39 times revenue; in Q2 2025, the multiple had grown by 55% to 3.69x. The same is true about virtually every one of its valuation metrics.

Despite moving the share price with smoke and mirrors, CAT remains on a roll. The Barchart Technical Opinion is a Strong Buy in the near term.

For this reason, I’d consider a long strangle, rather than a short strangle. In the case of the former, you’re paying out through a net debit, rather than bringing in through a net credit.

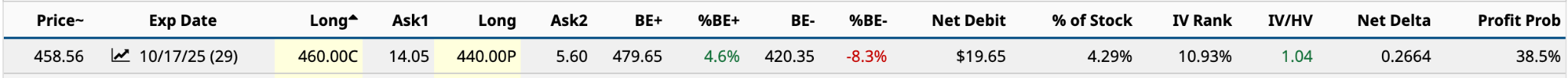

Based on the long strangle data for the $460 call and $440 put, as I write this in midday trading, the net debit of $19.65 is a reasonable 4.29% of the $458.56 CAT share price.

Based on the long strangle data for the $460 call and $440 put, as I write this in midday trading, the net debit of $19.65 is a reasonable 4.29% of the $458.56 CAT share price.

In this situation, you want the share price at expiration to be above or below its respective breakeven prices. The upside breakeven is $479.65, while the downside breakeven is $420.35.

The maximum loss is the net debit of $19.65; the maximum profit is unlimited.

For example, if CAT’s Oct. 17 closing share price is $481.49 (5% move), your profit would be $184 [$481.49 share price - $460 strike price - $19.65 net debit]. Better still, if CAT’s share price increased by 10% over the next 30 days, your profit would be $2,477 [$504.42 share price - $460 strike price - $19.65 net debit]. That’s an annualized return of 1,533.73% [$2,477 / $1,965] * [365 / 30].

CAT’s expected move over the next 30 days is 4.92%, which means you’ll probably break even on your long strangle, but the probability of a 10% move is likely around 15% or less.

To dream the impossible dream.

On the date of publication, Will Ashworth did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.