Cathie Wood Is Buying Up This Newly Public Crypto Stock. Should You?

/Jack%20Dorsey%20Twitter%20with%20Bitcoin%20by%20MacroEcon%20via%20Shutterstock.jpg)

Bullish (BLSH), a digitally native global digital asset platform centered on institutions, has gained momentum quickly since its August initial public offering. The new use case for stablecoins to raise $1.15 billion in proceeds with a historic regulatory milestone in New York has been a cause to be optimistic about among investors. To fuel speculation further, ARK Invest’s Cathie Wood has been buying shares as a signal to support its long-term future.

Bullish is entering public markets with rising regulatory certainty for digital currencies. The company has been awarded a BitLicense and a Money Transmission License by New York’s Department of Financial Services. It is now positioned to expand institutional-grade crypto services. As crypto and Bitcoin markets remain volatile, Bullish’s regulated platform could be appealing to institutions seeking to have a safe gateway to digital currencies.

About BLSH Stock

Bullish is a Cayman Islands-based digital asset trading and custody platform for professional traders and institutional clients. It provides crypto ecosystem liquidity, exchange solutions, along with information infrastructure. Bullish is headed by Tom Farley, former president of the NYSE, who is its CEO. It refers to itself as a reliable interconnection between blockchain-based markets and traditional finance.

BLSH shares are currently trading at $60 and have been on a tear today, up over 10% so far. Even so, BLSH stock has come down dramatically from a 52-week high of $118 but is still above its IPO lows near $48. In relative terms compared to the S&P 500 Index ($SPX), which has risen by over 15% year-to-date (YTD), BLSH is lagging at -16% as investors digest its rich valuation and early volatility.

That said, valuation is an area of disagreement. Bullish trades with a forward price-earnings (P/E) ratio of 317x that assumes minimal profits today but heavy reliance upon expansion to come. But with a price-sales (P/S) ratio of just 0.03, investors believe it is being sold cheaply relative to its reported transaction revenue base. Investors assume a razor-thin margin (profit margin of 0.03%) with a high-reward/high-risk situation.

It does not pay a dividend, and as an early growth-stage company, reinvestment into growth and compliance will take priority over shareholder distributions.

Bullish Surprises With Stablecoin IPO and BitLicense

Bullish’s historic August IPO occurred in U.S. markets. It launched $1.15 billion in securities fully in stablecoins like USDC, EURC, PayPal USD, and Ripple USD, custodied with Coinbase (COIN). It is an unprecedented move that combined time-honored IPO mechanics with blockchain rails to demonstrate crypto finance’s entry into mainstream capital markets.

Regulatory development has followed shortly. On Sept. 17, Bullish secured New York’s coveted BitLicense and Money Transmission License, making it eligible to offer spot trading and custody to institutions within one of the most heavily regulated American markets. Management cited regulatory clarity as a stepping stone to institutional adoption, with New York acting as a credibility boost to the platform.

Distinguishing positioning, making use of stablecoin liquidity, and doing business with high surveillance boost its competitive position. Thin profitability, though, calls for caution among investors because costs such as licensing costs and compliance costs would rise. Bullish has not announced a date for its subsequent earnings report.

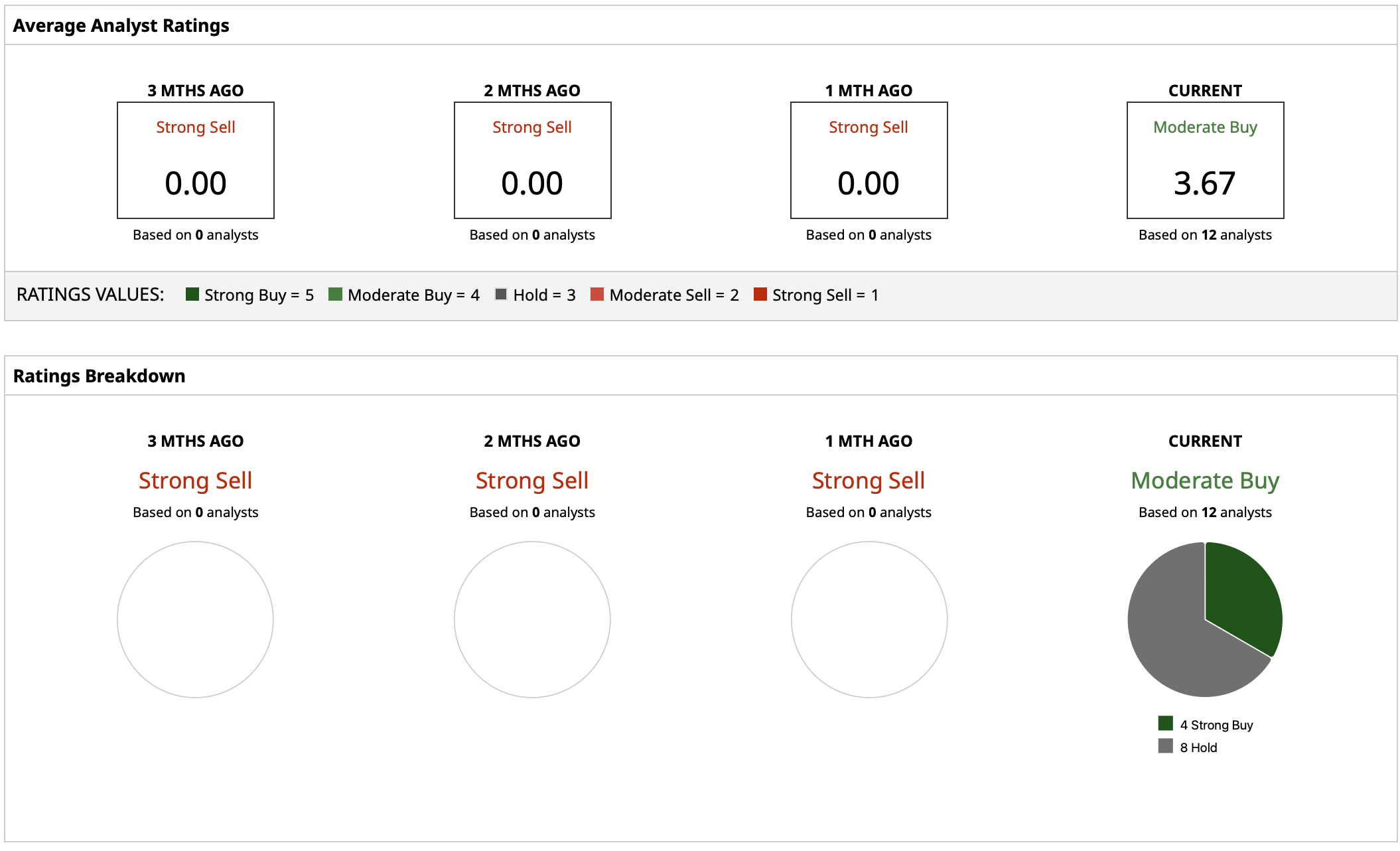

What Do Analysts Expect for BLSH Stock?

Bull sentiment remains positive with 12 analysts covering BLSH stock and a “Moderate Buy” rating, but this positivity is mixed with caution. While four of those ratings are “Strong Buys,” eight analysts say “Hold.” The stock has already shot past its mean target price of $56 and currently trades around $60. An upside case of $68 suggests a 13% upside. However, the $45 low-end price target carries a 25% downside implication.

Uncertainty surrounds BLSH stock, as some believe Bullish is a revolutionary crypto asset infrastructure play, but others worry about volatility, lean profitability, and regulatory cost.

On the date of publication, Yiannis Zourmpanos did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.